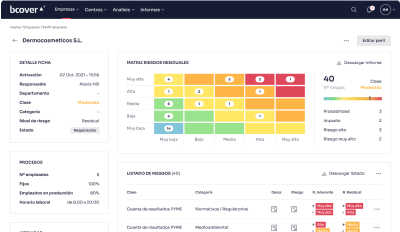

Risk analysis and assessment. Bcover allows you to simplify and automate the process of characterising, analysing and assessing the risks of your SME and commercial clients. Its intuitive interface allows you to quickly identify the most relevant risks of the company and recommend tailored insurance solutions for each one, as well as the implementation of other protection measures to avoid unwanted risks in the business environment.

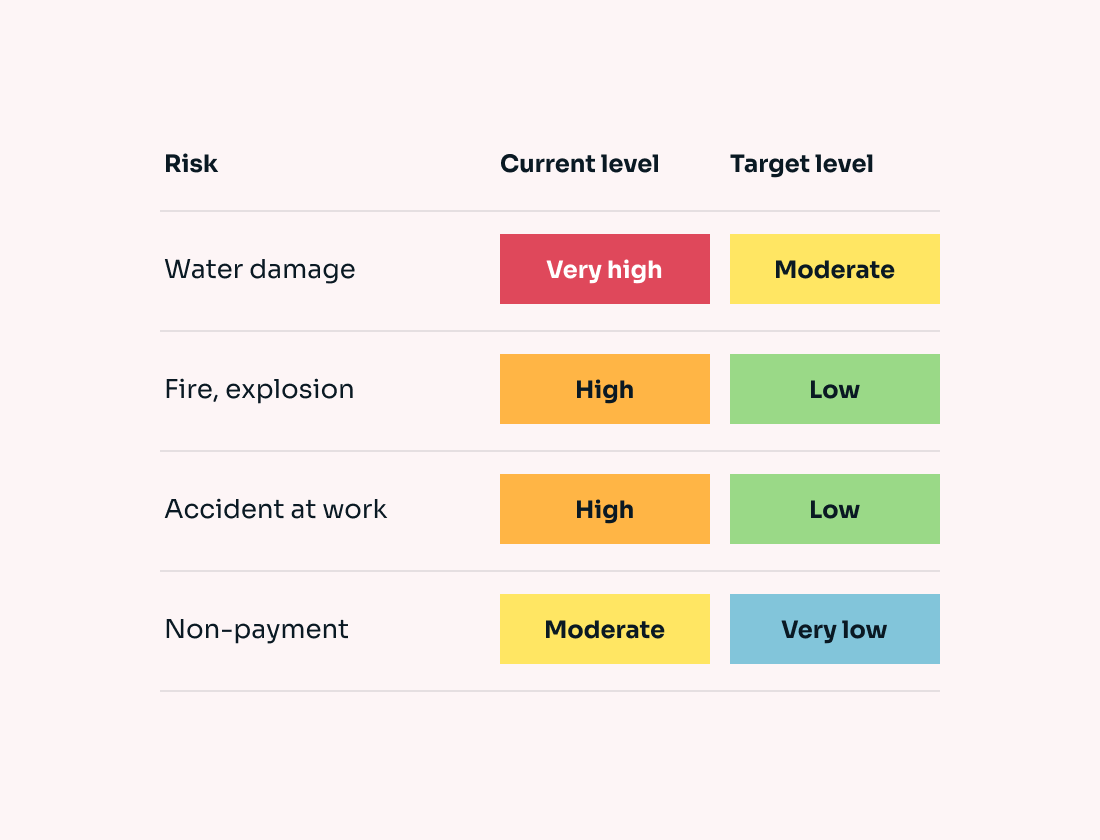

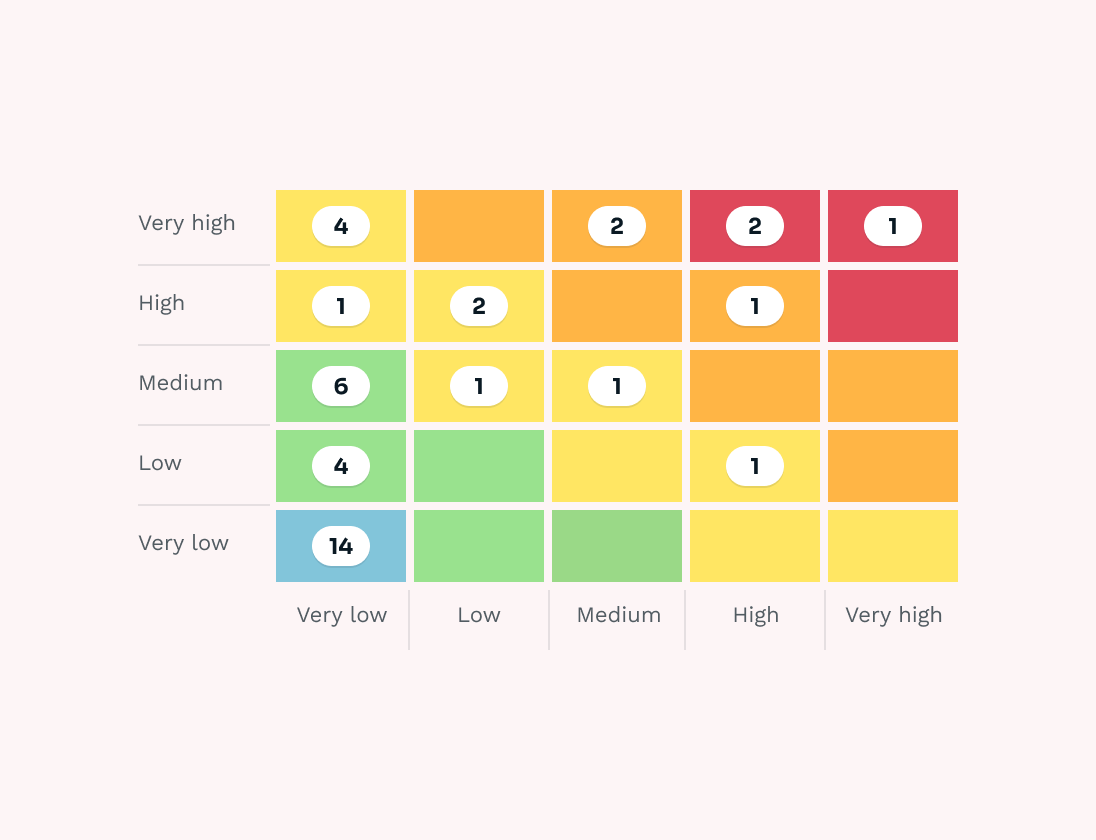

Current and target risk matrix. Matrix system for assessing the level of risk based on Likelihood and Impact (P x I). The application allows obtaining both the client’s current risk matrix and the target matrix that could be reached if the recommendations included in the management report are implemented. It uses the analysis as a sales argument for the insurance programme.

The Risk Management Report contains:

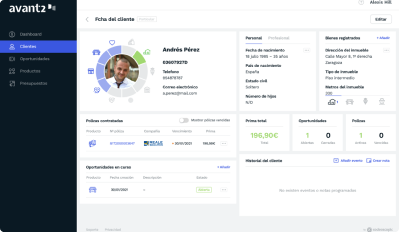

Quotation and issuance of policies. Thanks to the connectivity with Avant2 Sales Manager, Bcover allows you to generate quotes for those insurance solutions that our system has recommended to the SME or Trade customer. If you want to go ahead and issue the policy, you can open the opportunity generated in Avant2 Sales Manager and complete the underwriting process.

Technical risk verification report. Bcover allows you to analyse risks at a detailed level and generate a complete characterisation report, exportable to PDF and MS Word, with the standard formats required by insurance companies.

More than 1.800 brokers use Bcover Risk Management

Contact us!